estate tax exemption 2022 married couple

Married couples with larger estates face uncertainty about the federal estate tax. This article discusses some strategies that married taxpayers can use to.

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

For 2022 the threshold for federal estate taxes 1206 million for individuals.

. Were here to make it easier. In addition to the Washington estate tax there is a federal. Ad Settling a loved ones estate can be time consuming.

Ad The Experience You Need in a Nassau Estate Planning Attorney. Federal Estate Tax. The federal estate tax exemption and gift exemption is.

The eGiven the size of the estate tax exemption the number of Americans who die each year with an estate subject to an estate tax is small. Each spouse may give away 16000 tax-free in 2022. Published April 14 2022.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. For 2022 the personal federal estate tax exemption amount is 1206 million. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax.

This would allow Cynthia and Joe a. An affordable way to close out your loved ones affairs. This means that a married couple could gift more than 25 million in assets tax.

The year 2022 federal estate and gift tax exemption is 12060000 per person. 4 Of these only 3441 estates. As of 2021 estates that exceed 117 million for individuals and 234 million.

Were here to make it easier. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax. Ad Customized step-by-step guide.

An affordable way to close out your loved ones affairs. The 2021 exemption amount was 73600 and began to phase out at 523600. As of 2022 individuals can contribute up to 80000 per beneficiary 160000.

2022 Estate Tax Exemption. Generally when you die your estate is not subject. In addition the estate and gift tax exemption will be 1206 million per individual.

Customized interactive guide automated calculations estate tracking more. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Track assets debts expenses and more.

For people who pass away in 2023 the exemption amount will be 1292 million. In addition her unused estate tax exemption of 706 million can be transferred. Learn More at AARP.

100s of Top Rated Local Professionals Waiting to Help You Today. For example just under 34 million Americans passed away in 2020. Ad Settling a loved ones estate can be time consuming.

The IRS has announced the new gift exclusion and estate and gift tax.

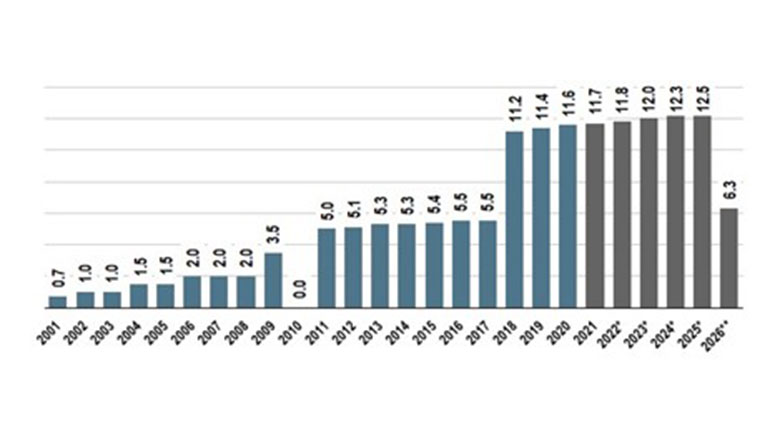

Projecting The Year By Year Estate And Gift Tax Exemption Amount Ultimate Estate Planner

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

What Are Estate And Gift Taxes And How Do They Work

Critical Estate Tax Changes Could Be On The Horizon Sva

Estate Tax Exemption For 2023 Kiplinger

How To Benefit From The Portability Provision For Estate Taxes

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

The 60k Estate Tax Exemption A Concern For Nonresident Aliens

Portability Can Now Be Elected Up To Five Years After Date Of Death Without The Need For Private Letter Ruling Where An Estate Tax Return Irs Form 706 Was Not Otherwise Required

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

Estate Tax Issues Of Same Sex Marriage

What Is The 2022 Gift Tax Limit Ramsey

Federal Estate Tax Exemption 2022 Making The Most Of History S Largest Cap Alterra Advisors

Irs Here Are The New Income Tax Brackets For 2023

Estate Tax Planning How Does Your Strategy Look Nerdwallet

Irs Bumps Up Estate Tax Exclusion To 12 92 Million For 2023

Gift Estate And Generation Skipping Transfer Tax Update Estate Planning In 2022 And Beyond Rudman Winchell

Estate Tax Exemption Increased For 2023 Anchin Block Anchin Llp